Revisit the Tax Talk Webinar and share it with other artist friends who may be asking similar questions.

Find great resources and information provided by True North Accounting. Explore the highlights below and click through to read & learn more.

SIDE HUSTLE TO REAL DEAL

Lots of people have a side hustle these days (check out Avenue’s recent article The Art of the Side Hustle). When your heart’s in the game and you start to make a few bucks, you may start to wonder: Could this be my day job?

If you find yourself mulling over that question, here are some practicalities to consider before you make the leap: READ MORE HERE

Lots of people have a side hustle these days (check out Avenue’s recent article The Art of the Side Hustle). When your heart’s in the game and you start to make a few bucks, you may start to wonder: Could this be my day job?

If you find yourself mulling over that question, here are some practicalities to consider before you make the leap: READ MORE HERE

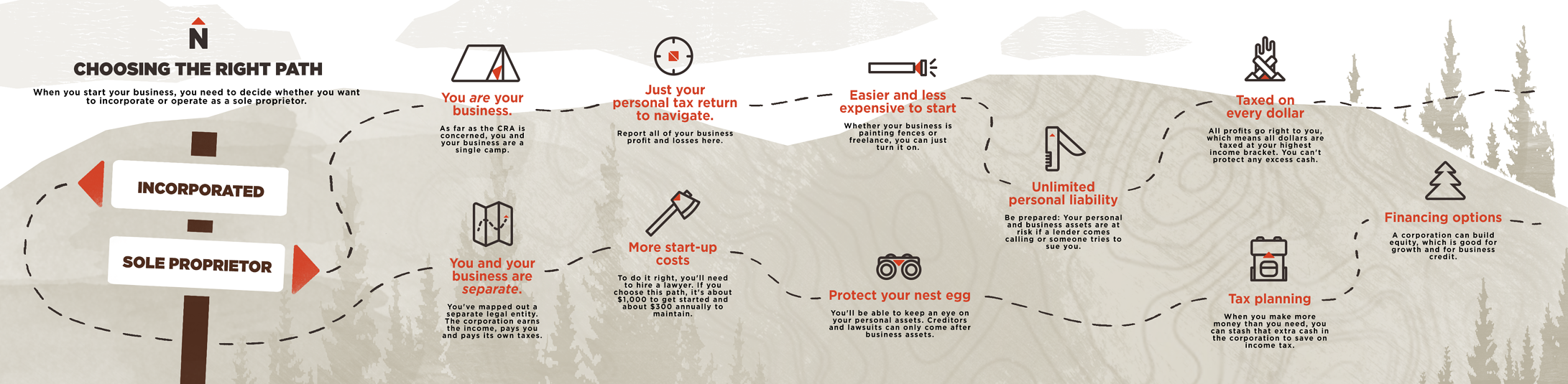

SOLE PROPRIETOR VS INCORPORATION: LEARN WHEN TO INCORPORATE

When you start your business, you’ll need to decide if you want to be a sole proprietor or if you want to incorporate. Not sure which is right for you? Let’s define and look at the pros and cons of both. READ MORE HERE

When you start your business, you’ll need to decide if you want to be a sole proprietor or if you want to incorporate. Not sure which is right for you? Let’s define and look at the pros and cons of both. READ MORE HERE

STEP-BY-STEP GUIDE TO BOOKKEEPING FOR SOLE PROPRIETORS

Bookkeeping is the task of recording all the day-to-day transactions of your business, like sales invoices, cash receipts and expenses.

READ MORE HERE

Bookkeeping is the task of recording all the day-to-day transactions of your business, like sales invoices, cash receipts and expenses.

READ MORE HERE

6-Step SIMPLE bookkeeping (a.k.a. Income-statement only)

- Start with a list (or chart) of accounts

- Gather your business transactions

- Sort your transactions

- Add expenses that didn’t go through the bank statement

- Income statement (a.k.a. Profit and Loss)

- Home office expenses

CLOUD BOOKKEEPING SOFTWARE

If you do choose to use bookkeeping software, great! Here are a few tips on the fundamentals.

A note on balance sheets

Bookkeeping software uses double-entry bookkeeping, which builds both the income statement and balance sheet. Most sole proprietors don’t really need a balance sheet, since there is no separation between the person and the business.

We recommend only using software if you need to. The end result is unreliable if the bookkeeping is not done right or is incomplete.

Xero or QBO are our cloud bookkeeping software recommendations. Both require some training and background in double-entry bookkeeping to be really effective.

If you choose to go this route, your goal is to prepare a proper general ledger and trial balance, which tracks assets, liabilities, sales and expenses. READ MORE HERE

If you do choose to use bookkeeping software, great! Here are a few tips on the fundamentals.

A note on balance sheets

Bookkeeping software uses double-entry bookkeeping, which builds both the income statement and balance sheet. Most sole proprietors don’t really need a balance sheet, since there is no separation between the person and the business.

We recommend only using software if you need to. The end result is unreliable if the bookkeeping is not done right or is incomplete.

Xero or QBO are our cloud bookkeeping software recommendations. Both require some training and background in double-entry bookkeeping to be really effective.

If you choose to go this route, your goal is to prepare a proper general ledger and trial balance, which tracks assets, liabilities, sales and expenses. READ MORE HERE

RECEIPTS AND RECORD KEEPING: WHAT TO KEEP AND HOW TO ORGANIZE

Bookkeeping is the day-to-day task of recording and categorizing your business transactions. READ MORE HERE

Bookkeeping is the day-to-day task of recording and categorizing your business transactions. READ MORE HERE

- SEPARATE BUSINESS AND PERSONAL BANK EXPENSES

- KEEP YOUR RECEIPTS

- DOWNLOAD YOUR BANK STATEMENTS

- HOW TO TRACK NON-BANK EXPENSES

- DIGITIZE YOUR PAPER RECORDS

- HOW TO PAY YOURSELF

- WHAT NOT TO DO

WRITE-OFFS FOR THE FUN-LOVING BUSINESS OWNER

As a business owner, knowing what you can write off can save you money and limit the risk of an audit. Get informed and be confident in your spending. Here are some write-offs that'll reduce your taxable income, put a big smile on your face, and keep your wallet full. READ MORE HERE

As a business owner, knowing what you can write off can save you money and limit the risk of an audit. Get informed and be confident in your spending. Here are some write-offs that'll reduce your taxable income, put a big smile on your face, and keep your wallet full. READ MORE HERE

- Technology and gadgets

- Entertainment

- Food & Drinks

- Staff Parties

- Client and Sales Events

- Donations & Sponsorship

- Annual General Meetings

- Travel

- Travel to and out-of-town conference or training seminar

GST FOR DUMMIES (GST 101)

Good and Services Tax: consumers know they pay it, and business owners know they charge it, but do you know why? As the GST deadline approaches for many businesses, we wanted to share some GST 101: what GST is, and how you, as a business owner, can calculate how much you’ll need to pay. READ MORE HERE

GST Basics (Goods and Services Tax)

Business owners are required to charge GST on the sale of pretty much all goods and services they sell (the exceptions are discussed later). They are required to collect it and remit it to the government - and that extra 5% they collect belongs to the government - right from the get go. It is not the business’ money.

Good and Services Tax: consumers know they pay it, and business owners know they charge it, but do you know why? As the GST deadline approaches for many businesses, we wanted to share some GST 101: what GST is, and how you, as a business owner, can calculate how much you’ll need to pay. READ MORE HERE

GST Basics (Goods and Services Tax)

Business owners are required to charge GST on the sale of pretty much all goods and services they sell (the exceptions are discussed later). They are required to collect it and remit it to the government - and that extra 5% they collect belongs to the government - right from the get go. It is not the business’ money.

- When Do You Need To Start Collecting GST

- Calculating How Much GST You Owe

- Net GST

- Quick Method

- Exemptions From GST

- Reporting Periods

- How to Register for a GST Account

- The info required to register

- Instalments

- Filing your GST Return

APPS, TOOLS AND TEMPLATE

Some resources to put in your pocket: accounting and bookkeeping templates, and samples. Plus, the best in small

busuness apps and calculators. FIND THEM HERE

Some resources to put in your pocket: accounting and bookkeeping templates, and samples. Plus, the best in small

busuness apps and calculators. FIND THEM HERE

Thank you to our friends at True North Accounting for sharing this valuable information.

SIGN UP FOR THE TRUE NORTH MONTHLY NEWSLETTER